OmniPay

Digital Transaction Platform

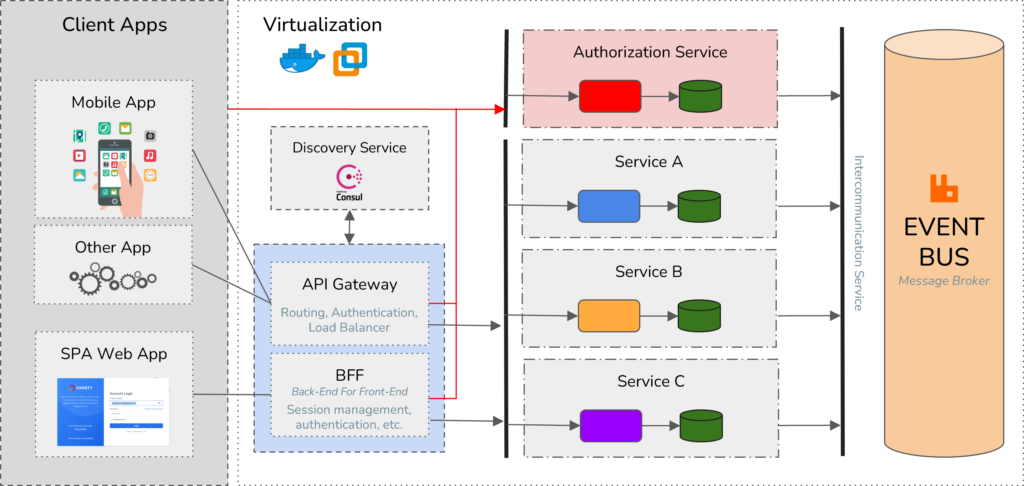

One of the Full Stack Technology solutions provided as an answer to the market need to accelerate the adoption of the latest technology into their business. OmniPay is designed to be a kind of Platform (“Platform”) in bridging digital transactions such as Debit and Credit (VISA, Mastercard, JCB, Amex, CUP, etc) including GPN (in Indonesia), prepaid, QR payment and others.

![]()

![]()

![]()

![]()

![]()

![]()

- Easy to Customize, by using Android base and by using API technology for messaging, it will be very easy for developers to develop applications according to their respective needs

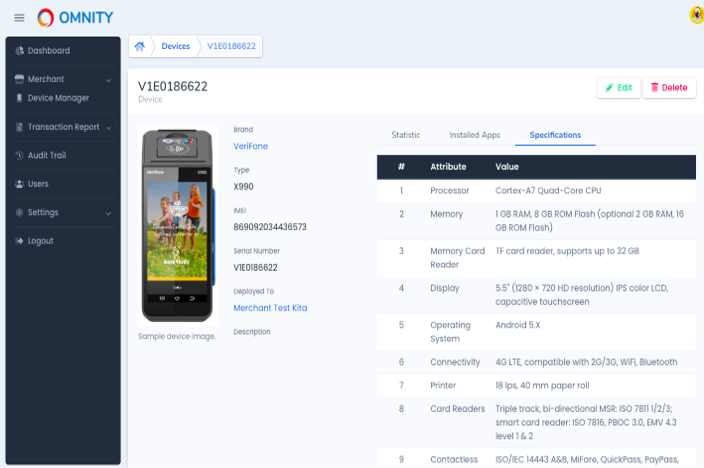

- Multi Brand/Brand Agnostic, can be developed for various leading POS/EDC brands, which use the android operating system.

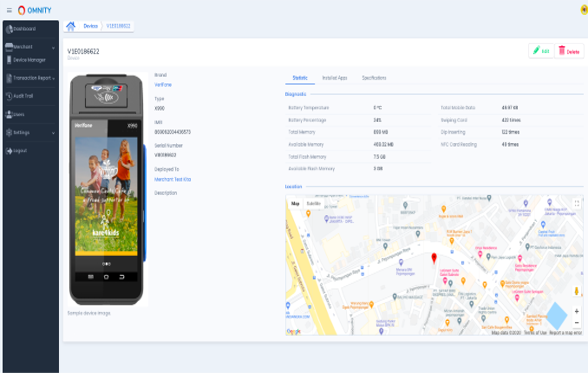

- Control & Monitoring, support to control the capabilities of EDC devices such as cameras, GPS) and also perform health checks such as temperature, battery level, storage information on the device. And send notifications for a condition set by the user regarding the EDC condition.

- Push Notification, support Real-time notifications.

- ECR Cloud, this payment application can be integrated with other devices such as Kiosk, POS, Vending Machine. This integration is done via the API.

- Multi Bank/Multi Acquiring, the application is designed to be able to handle and manage more than one banks/acquirers.

- Multi Vendor, support development from other vendors using the API that has been prepared.

- Easy to configure, print receipt format/logo can be made flexible and varies according to corporate identity, by displaying additional info on the slip for loyalty purposes or promotional info for certain stores and card types.

The feature requirements that EDC will have are as follows:

- TLE (Terminal Line Encryption), security mechanism to secure data from EDC to host bank.

- Payment, purchase transactions at merchants (using credit/debit card).

- Credit Card, supports transactions using principal cards (Visa, Master, JCB, Amex, CUP and other principals) or bank private label cards (chip cards with contact or contactless, with EMV standards, or magnetic stripe)

- Debit Card, supports transactions using Bank Debit Cards (Visa, MasterCard, GPN) or bank private label cards (chip cards with contact or contactless, with EMV, NSICCS and Magnetic Stripe standards)

- The EDC terminal (Payment Application) is integrated with the POS terminal using ECR Cloud connectivity.

- The EDC is certified as an APMK (Card-Based Payment Instrument) from the authorized institution and is required to attach a certification document.

- Other Android EDC features if needed such as smart behavior and distribution of various government assistance and others.

- Flexible EDC Configuration: Payment applications on devices developed with thin client networks, this makes it easy for clients to configure payment applications without making many changes.

- Parameter Configuration: This feature makes it easy for clients to configure several parameters such as menus, workflows, device parameters, agent parameters, BIN range, CAPK Master, receipt and uploaded files by adding and/or subtracting features available in the EDC Android application through the TMS portal so that can optimize the client’s operational business.

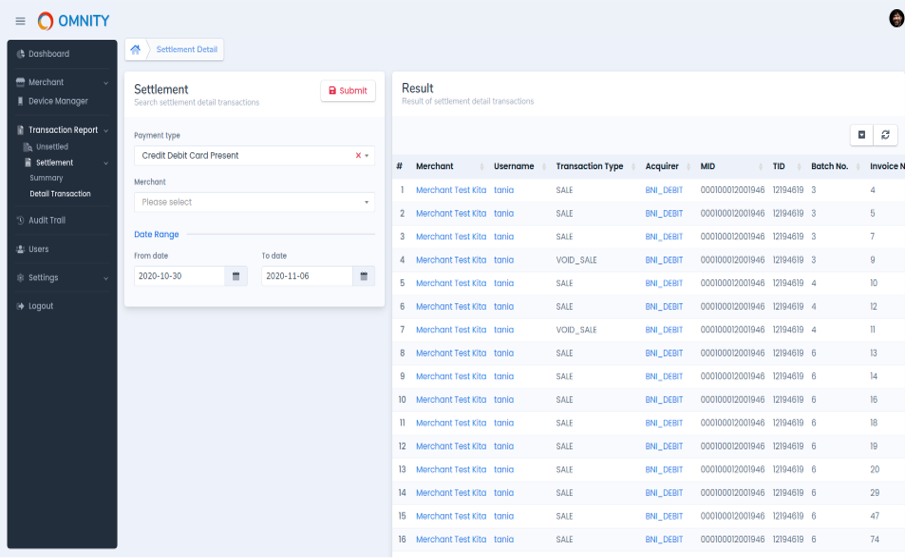

- Host to Host Settlement:

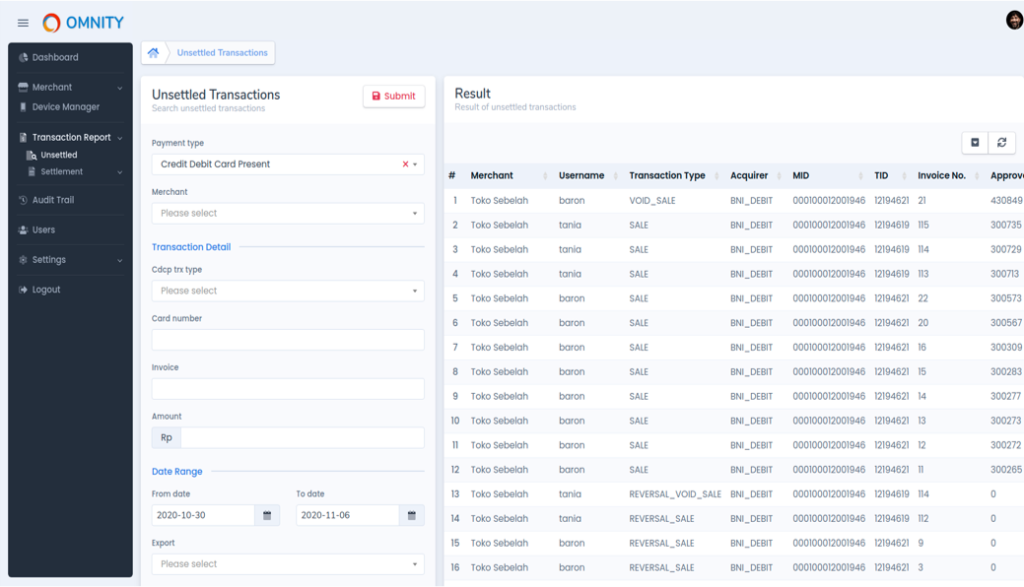

- This solution has the ability to configure the settlement period for different issuers/programs and frequencies.

- The basis of the configuration of settlement, reconciliation and settlement is done automatically. Auto settlement reports are generated for card issuers or Merchant Payouts.

- Customization regarding the Bank settlement file is required to generate a merchant payout file

- Dynamic Dashboard: User-configurable dashboard according to specific needs. The display from the dashboard can display a graph of the financial report that can be adjusted according to the client’s wishes. Various types of reports can be configured on demand.

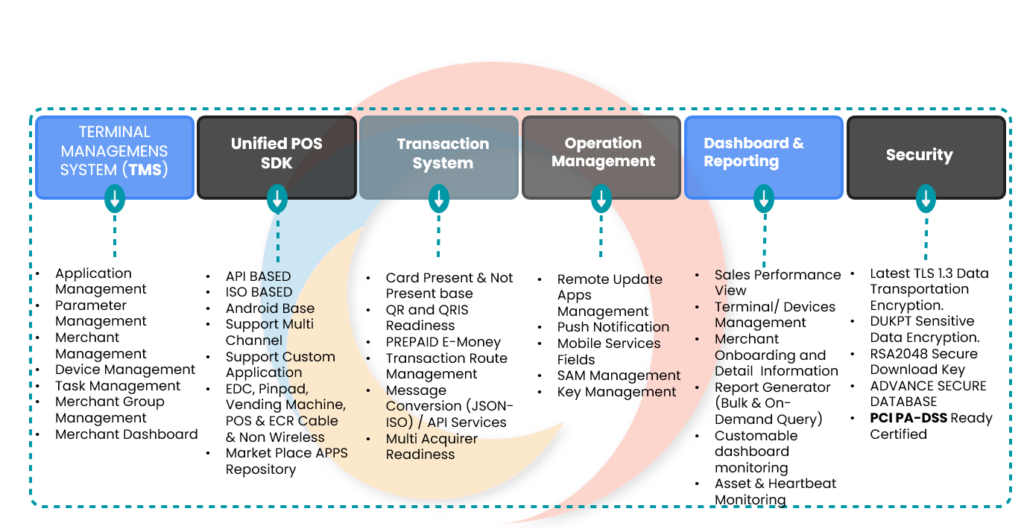

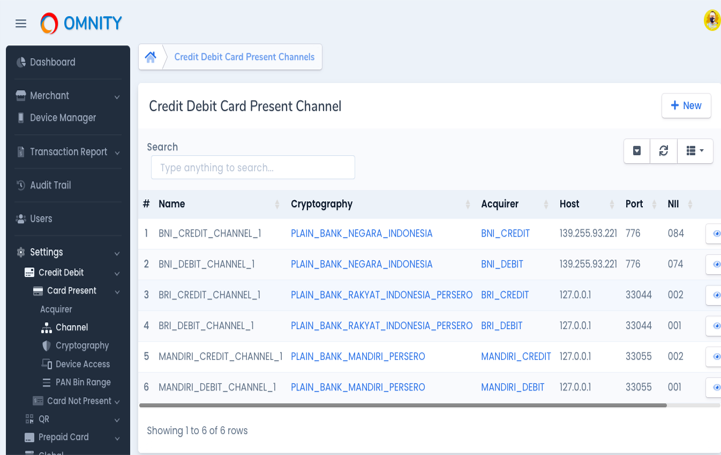

- TMS: The TMS feature provides a solution by providing an integrated API to monitor and maintain terminal status. Configuration for various types of devices and devices that are integrated with the system.

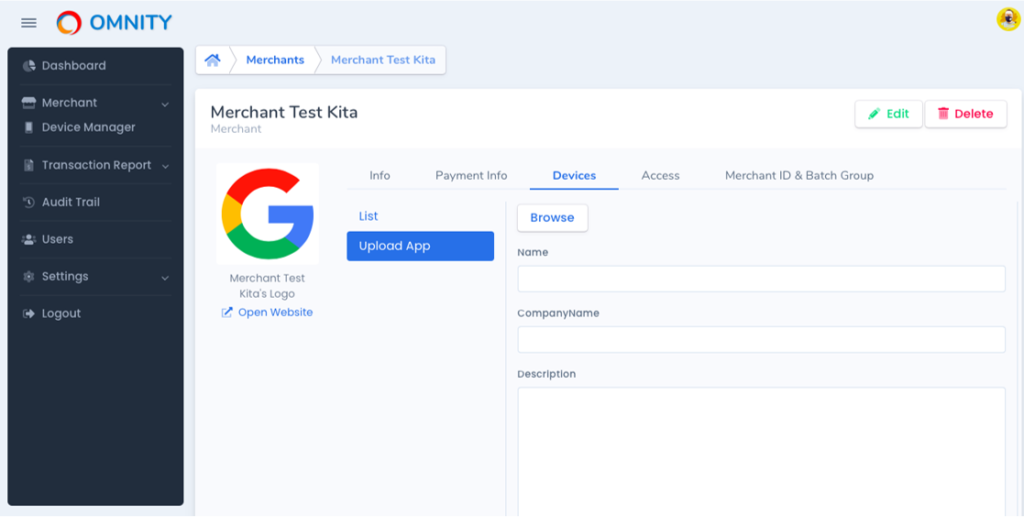

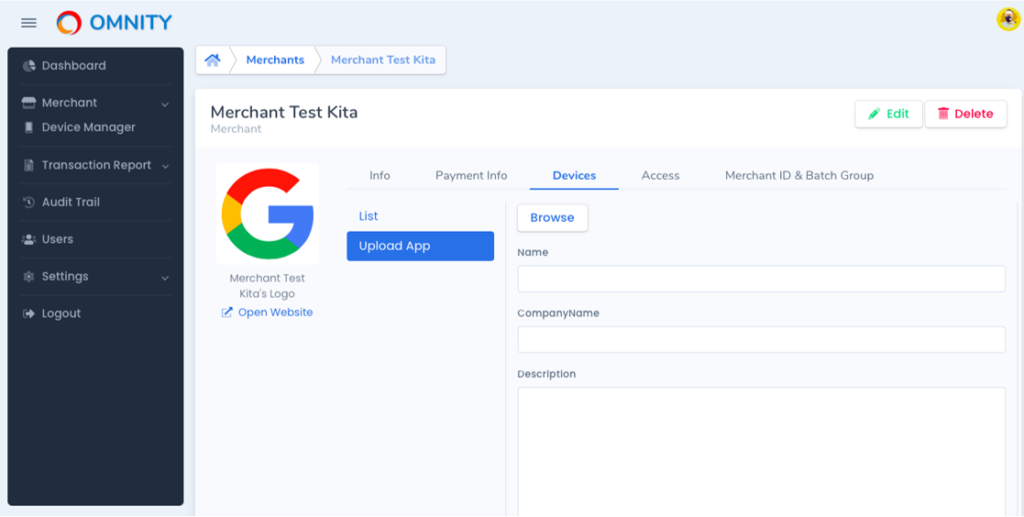

- Multiple Client Management: This feature makes it easy for users to add and display stakeholder information that supports business processes.

- Multiple Application Management: The applications function as a marketplace from EDC so that clients can manage various applications they want to download from EDC for each client stakeholder. This feature serves to make it easier for clients to update remotely (remote updates) as well as manage the schedule for updating the latest version of the application on a specific device or group based on changes made in the system. This feature can also monitor the validation of the number of devices that have been updated.

- Device Sharing: The device sharing feature makes it easy for clients to provide services to client stakeholders to manage 1 EDC connected to several devices such as Electronic Cash Register (ECR), KIOSK, and other payment devices that require debit/credit cards and payment receipts.

- Bill Payment: Payment activities on the device will be connected to the bill payment feature available on the TMS portal, making it easier for clients to see each payment status within the specified timeframe. Clients can also filter the types of transactions they want to view according to their wishes. In addition, this feature can also generate e-receipts from every transaction received and sent to the user via whatsapp or email.

- Receipt Management: The configuration feature is used to set the receipt template for each type of transaction according to the client’s wishes. This configuration can be used by the client to set the receipt function as a promotional medium.

- Cashier Management: This feature makes it easy for client stakeholders to manage every transaction that takes place and will send a cashier id to the server. The features available in cashier management are add cashier, login cashier and logout. This feature will also provide a performance report from the cashier that can be obtained from the system.

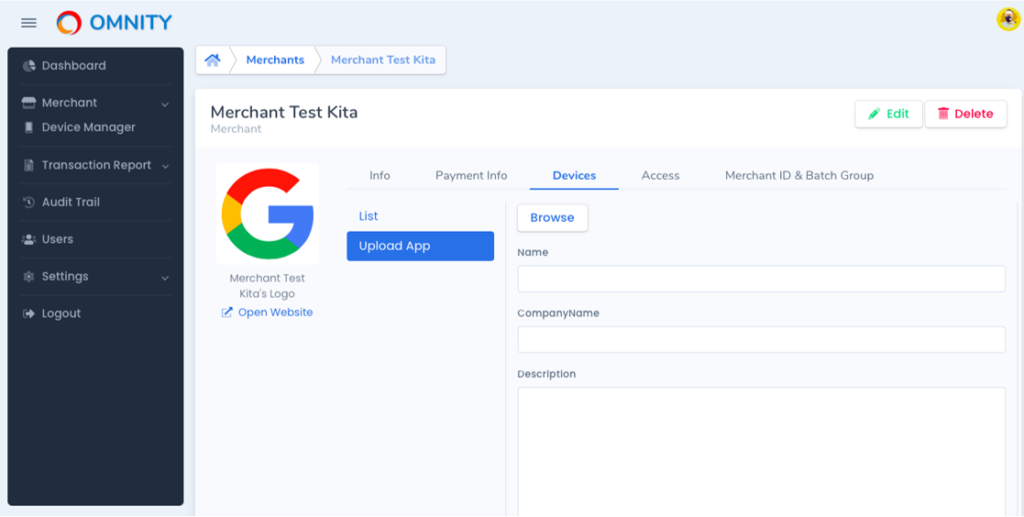

- Merchant/Outlet Portal: This merchant feature can display, change information data from each merchant, outlet and terminal and can add it specifically and/or in groups with a maximum of 5000 (five thousand) merchant lists.

- EMI/Installment: On us / Off us Installation and Brand/Partner Installment Processing. The solution has features to define Manufacturer, product groups, product and SKU. The solution has a feature to define the installation schema based on issues based or manufacturer based.

Solution has provisions to determine the rules for installments (total transaction basis, product, SKU, time range and location). In addition, this feature also provides clients with loyalty management, merchant loyalty cards, sharing, partner integrations, vouchers/coupons and Merchant/third party promotion.

- Merchant/Issuer Promotion Management

- The system supports defining campaigns for merchants and issuers and attaching various rules as eligibility criteria

- Flexible Execution Frequency – Per transaction, One-time, Periodic recurring

- Campaign Output as a coupon, barcode or text that can be printed on the receipt as text, barcode, coupon

- Real Time Monitoring: This feature can help clients to monitor several conditions such as Device Monitoring (Heartbeat System), transaction monitoring, system monitoring (Application Monitoring), exceptions and alerts.

- Flexible Reporting: This feature can display various reports such as merchant transactions, device transactions, Financial Transactions, Exceptions Transactions. It also makes it easier for clients to get reports on identification of abnormal devices and failed transactions.

- Integrasi dengan Aplikasi Pihak ketiga: Memiliki kemampuan untuk diintegrasikan dengan aplikasi pihak ketiga.

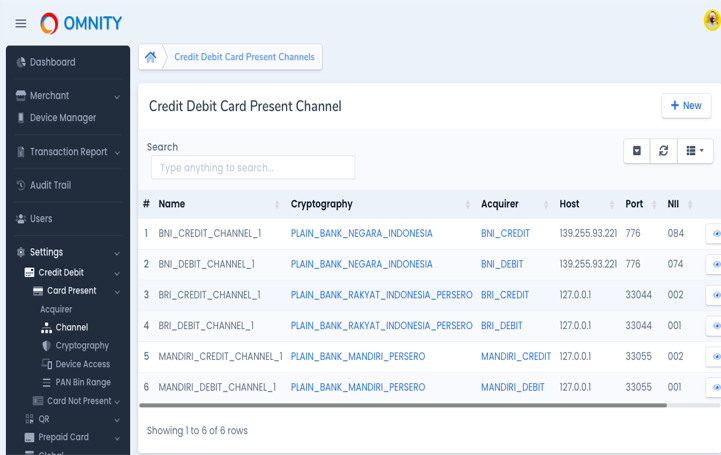

- Multi Acquire Bank: Has the ability to integrate acquirers into various banks that support debit and credit payments.

- ECR Cloud: Electronic Cash Register that can be accessed wirelessly and supports cloud base.